Missouri offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Clean Energy

Energy Resources

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Missouri State Capitol

PO Box 809,

Jefferson City, Missouri 65102

Phone: (573) 751-2854

Email: [email protected]

Hours: M-F 8:00am-5:00pm

Hours: Weekends 8:00am-4:00pm

Ameren Missouri

1901 Chouteau Ave,

St. Louis, MO 63103

(800) 552-7583

Hours: M-F 7:00am-10:00pm

Hours: Weekends 8:00am-4:00pm

Energy Division

Missouri Department of Natural Resources – Division of Energy

1101 Riverside Drive

P.O. Box 176

Jefferson City, MO 65102-0176

Main: 573-751-2254

Toll-free: 855-522-2796

Fax: 573-751-6860

Email: [email protected]

Hours: M-F 8:00am-5:00pm

Kansas City Weather Bureau

1803 North 7 Highway

Pleasant Hill, MO 64080-9421

Phone: (816) 540-6132

Email: [email protected]

Hours: M-F 8:00am-6:00pm

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Columbia Water & Light Rebate | Approx. $6,250 | Applied one time after solar equipment installation |

| Evergy Solar Rebate | Approx. $2,525 | Applied one time after solar equipment installation |

| Empire District Electric PV Rebate | Approx. $2,525 | Applied one time after solar equipment installation |

| Property Tax Exemption | 100% | Property tax on the increase in home value from renewable energy upgrade |

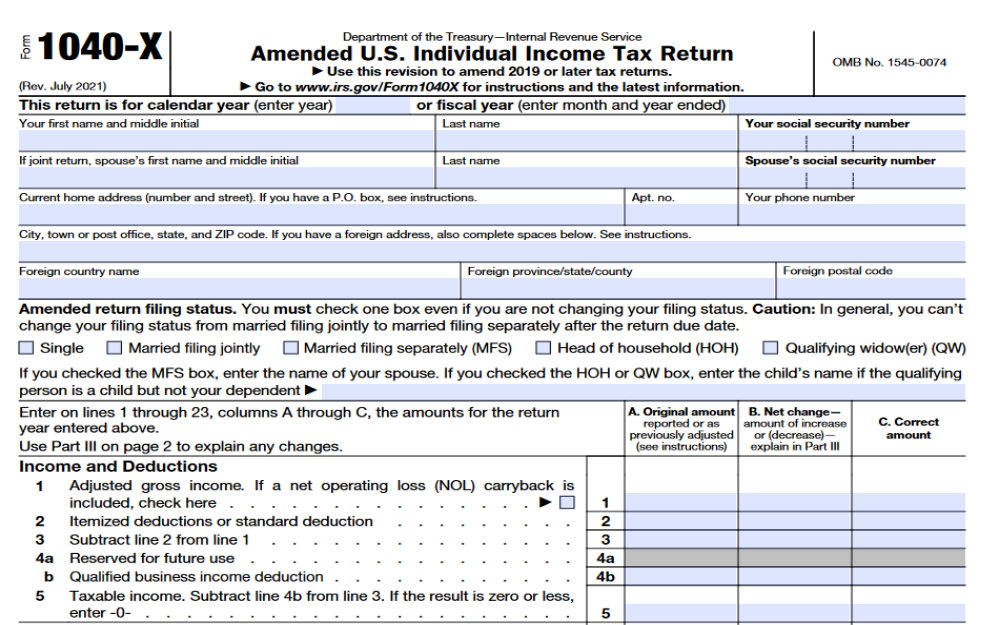

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Missouri Department of Natural Resources

Residential & Community

Business Industry

Transportation

Energy Resources

Energy Efficiency

Weatherization

Grants & Loans

Power Outage Map

Missouri Department of Natural Resources

1101 Riverside Drive

PO Box 176

Jefferson City, MO 65102-0176

800-361-4827 or 573-751-3443

Monday – Friday

8 AM – 5 PM

Division of Energy

Main: 573-751-2254

Toll-free: 855-522-2796

Fax: 573-751-6860

Email: [email protected]

Energy Efficiency Program

Main: 573-751-2254

Toll-free: 855-522-2796

Fax: 573-526-7553

Email: [email protected]

Weatherization Program

Main: 573-751-2254

Toll-free: 855-522-2796

Fax: 573-526-7553

Email: [email protected]

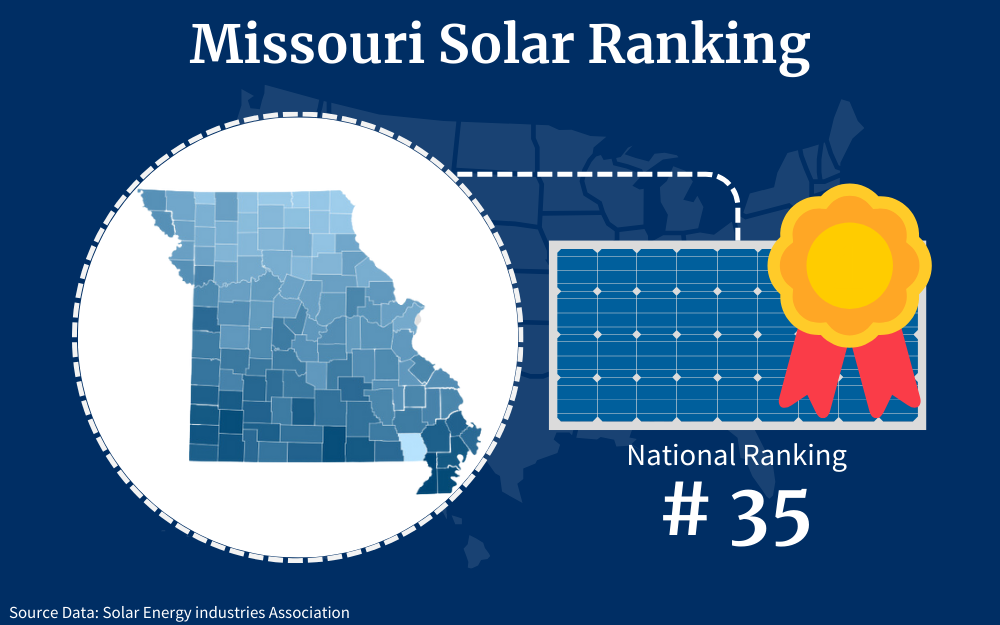

Missouri ranks 35th in the country when it comes to installed solar capacity,1 making Missouri solar incentives are great way to help encourage the adoption of green energy options for residents.

In fact, the ‘Show Me State’ has programs available to increase solar energy’s accessibility, and other renewable energy options available for enrollment.

What Rebates and Solar Credits Are Available in Missouri?

Not only is solar power power considered green energy, it’s a great way to potentially increase the value of your home, reduce your energy bills and emissions, and in come cases, generate an income based on the solar farm size.

This guide explains the Missouri solar incentives, rebates and credits residents can register to receive, and provides valuable information on solar power home installation and how to on choose the best panel solar system for your property.

Missourians interested in solar modules can utilize many different programs, including solar tax credits.2 These credits lower your income, which in turn reduces the total amount of money you owe when you file your taxes.

In addition to solar tax credits, several Missouri utility companies also offer rebates to encourage residents to transition to alternative energy sources (including solar power).

Here are some of the most beneficial utility-offered solar programs offered in Missouri:

Columbia Water and Light Rebate

Under this program,3 any homeowner who is a Columbia Water & Light customer can qualify for rebates depending on their system’s size.

How much of a rebate are you eligible for? The program’s rebate tiers are as follows:

- 0 to 10 kW: $375 to $625 per kW

- 10 to 50 kW: $300 to $500 per kW

- 50 to 100 kW: $150 to $250 per kW

Columbia Water & Light also offers solar photovoltaic (PV) system loans (up to $15,000 for residential customers and up to $30,000 for commercial customers).4

Ameren Solar PV Rebate Program

If Ameren provides your electricity, you can also qualify for rebates after installing a solar panel system on your property. However, this rebate is only available through the end of this year.

If your system was installed before December 31, 2023, you can receive a rebate of $0.25 per watt.5 The maximum solar system size is 25 kW (that’s more than double the average system size, so you’ll almost certainly qualify).

Liberty Utilities Rebate

Not an Ameren customer? Liberty Utilities offers the same solar rebate incentive,6 which includes a $0.25 per watt rebate.

This utility company’s customers are also eligible for rebates of up to $0.25 per watt through December 31, 2023.

Renewable Energy Programs Offered by the Government

Along with solar energy programs offered by utility companies, the federal and Missouri state governments also provide incentives and credits for residents who are interested in switching to more renewable energy sources.

The most relevant government-sponsored programs are described below:

Residential Clean Energy Credit

The Residential Clean Energy Credit is a federal tax credit equal to 30% of the costs associated with a new solar panel system.7 Here are some frequently asked questions about this popular credit:

- Who qualifies for solar tax credit? You can claim this credit if you have made any solar-related improvements to your primary home.

- What are the limits on the solar tax credits and rebates? The Residential Clean Energy Credit is nonrefundable, and the credit you receive can’t exceed what you owe in taxes.

- How often can you claim the Residential Clean Energy Credit? Every year you install solar-related equipment, you can claim this credit (from now until 2033, when the government will start to phase it out).

- What counts as eligible solar-related expenses? Examples include panels, inverters, mounts, labor costs, and battery storage equipment.

Solar Property Tax Exemption

You can increase your property’s resale value by 4.1% just by installing solar panels.8

The good news doesn’t end there, though.

Because you’re a Missouri resident, you can enjoy a property value boost without seeing an increase in your property taxes.9 The state exempts solar panel-related increases from additional taxes.

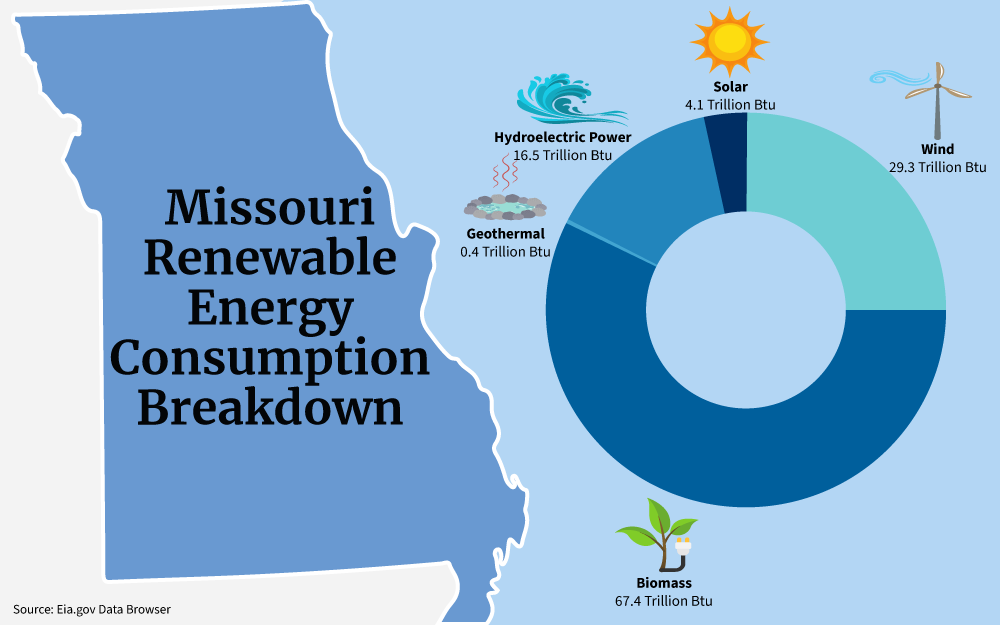

This helps increase the current renewable energy consumption in the state.

Property Assessed Clean Energy (PACE)

If you can’t afford the upfront cost of solar panels, consider the Property Assessed Clean Energy (PACE) program.10

PACE is a financing option geared toward those who want to make energy-efficient home improvements, such as installing solar panels. If you qualify for this fixed-rate and secured financing, your repayments will be included in your annual property tax bills.

Remember that not all Missourians are eligible for PACE financing because this program is only available in certain cities and counties. The state’s interactive PACE map can help you determine whether or not you live in a qualified area.11

How To Apply for Solar Credits and Rebates in Missouri

How do you apply for specific solar credits and rebates after your solar panel system has been installed?

The process varies depending on which incentives you want to take advantage of.

Applying for Solar Credits

To apply for the Residential Clean Energy Credit, you must fill out IRS Form 5695.12 When filling out this form, you’ll go through the following steps:

- Calculate the solar power system cost

- Add relevant energy-efficient improvements (solar water heating, wind energy generators, etc.)

- Calculate the tax credit value by multiplying the cost of your system by 30%

- Calculate tax liability

- Calculate the maximum tax credit you can claim

- Calculate carry-over credit

- Enter the credit on Form 1040 and finish filing your taxes

You can complete these steps more easily if you have all the documents from the installation process readily available (this includes receipts, invoices, etc.).

Applying for Rebates

The specific rebate application process varies based on each utility company’s unique requirements. In general, though, you’ll need to contact your specific utility provider and let them know you want to participate in their program.

A representative from the utility company will tell you the specific steps you need to take to enroll. They may also ask for information about when your system was installed (remember that the Ameren and Liberty Utilities rebate programs are only available through the end of 2023).

Make sure you have these details readily available to speed up the process.

How Can I Sell Power to Missouri?

Did you know that you can sell power generated by your solar panel system back to the state of Missouri (or, more specifically, to the state’s utility companies)? This process is known as net metering, and it’s yet another benefit of switching to solar.

Net Metering

Net metering provides solar homeowners with credits for the extra electricity their systems generate.20 These credits help to offset monthly electricity bills and protect homeowners from paying more when energy costs rise.

As a bonus for taking advantage of Missouri solar incentives through the net metering program, generating electricity with your solar panels also helps you to reduce your total carbon footprint not only in Missouri but also in other parts of the country.

In Missouri, net metering is available for a variety of renewable energy sources, including photovoltaic cells and panels. It also applies to hydroelectric and wind sources.

Before you decide to participate in net metering, keep in mind that you don’t get paid directly for the energy you sell back to the utility company.

You only get credits on your electricity bills (some people mistakenly think that because they’re “selling” energy, they will get cash in exchange).

What Materials and Parts Do You Need for Solar Panel Systems?

In most cases, if you’re interested in solar panels for your home, you’re also curious about what makes up your system, including any solar cover options. Additionally, you’d probably want to know how much it will cost and how much it will save you over time.

Here’s a breakdown to help you understand what you’re getting when you pay for a solar system:

Components of a Solar Panel System

One of the potentially bad things about solar energy is that you have to pay for more than just the panels when you add a system to your home. The following are some other elements included:

- Inverter: An inverter takes the electricity collected from the solar panels and converts it to electricity used to power your home.13

- Electrical panel: An electrical panel distributes energy throughout the home.

- Electric meter: A meter measures the electricity flowing in and out of the home.

Some people also invest in an Energy Storage System (ESS). This system lets you store extra electricity generated by your solar panel system so you can use it later, like during a power outage.

Average Cost of Solar Panels in Missouri

Solar panels are generally priced by watt. In Missouri, they cost $2.40-$2.60 per watt.14

Based on that number, a 250-watt panel would cost between $600 and $650. The number of panels needed for your system depends on the size of your home (as well as other factors like the direction it faces and the type of roof you have).

The average home needs between 16-20 panels. If each panel costs $600-$650, the entire collection of panels would cost somewhere between $9,600 and $13,000.

Remember that these numbers are calculated without factoring in any incentives or credits. Say you qualified for the 30% tax credit, for instance.

The panels would end up costing between $6,720 and $9,100 after you apply for the credit.

How Long Are Solar Panels Good For?

Solar panels typically last 25-30 years before they need to be replaced, addressing the question of “how long are solar panels good for?”

Remember that many installers also offer warranties, too, so if something goes wrong with the panels, you can likely get them repaired without getting hit with any exorbitant fees.

Can You Buy Used Solar Panels?

It’s unlikely you can get used solar panels for free in Missouri. However, if you’re thrifty and have the time, you may be able to get used or surplus solar panels at a significant discount, especially if you check out local classified ads.

Before you start your search for used panels, keep in mind that you’ll be forfeiting certain incentives. For example, the federal tax credit only applies to new systems and equipment.

Can You Lease Solar Panels?

Suppose you can’t afford to pay for a system in cash and don’t want to take out a loan, but you still want solar panels. In that case, consider a solar lease.15

This option requires a flat monthly fee to have solar panels installed on your roof and benefit from reduced power bills.

The downside to this option is that you do not own the panels (no matter how long you pay the monthly rental bills) unless you’ve specifically signed up for a rent-to-own program. You also don’t get any tax benefits.

What Is a Power Purchase Agreement?

A Power Purchase Agreement also eliminates the upfront payment.16 This agreement takes place between a homeowner and a third-party developer.

The developer handles all aspects of the solar installations and operation. They also own the system.

The homeowner then buys the electricity generated by the system (the cost is usually lower than the homeowner’s average electricity bill).

PPAs can make solar energy more accessible to people who can’t afford the upfront costs associated with a full solar panel system. However, there are also some downsides to this option.

For example, the system’s owner (not the homeowner) is the one who qualifies for certain tax credits. They also earn additional income money from selling the electricity.

How To Use a Residential Solar Panel Calculator

The average home needs between 15 and 20 solar panels.17 However, your home might require more or fewer depending on its size, the direction it faces, etc.

To find the exact number of panels you need, you’ll need to know a few other numbers and consider some additional factors, including these:

Monthly Electricity Usage

Look at your recent utility bills to get an idea of how much energy your household uses per month. For reference, the average home in Missouri uses 1,039 kWh per month.18

The more energy your home uses, the more panels you need to generate enough electricity to keep it running. A solar panel watts calculator can help you get an accurate number for your property.

Solar Panel Wattage

Wattage describes the electrical output each panel generates. Most solar panels have a wattage of 250-400.

A lower wattage typically means you’ll need more panels.

Production Ratios

A production ratio compares a system’s estimated energy output (in kWhs) to the actual system size (in watts). Say a 10 kW solar panel system generated 14 kWh of electricity.

The production ratio would be 1.4. In general, areas that get lots of sunlight have higher ratios and cloudier areas usually have lower ones.

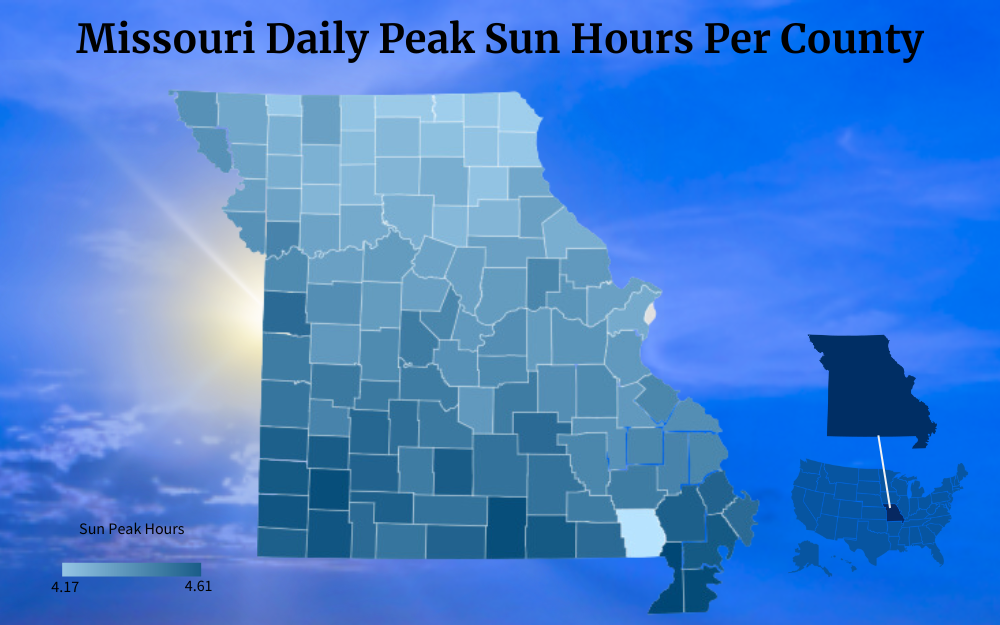

Sunlight and Climate in Your Area

Speaking of sunlight, the number of peak sunlight hours (i.e., hours when the sun’s rays are most powerful and your solar panels get the most direct light), also known as irradiance, in your area will also influence the number of panels you need.

Missouri gets approximately 4.73 daily peak sun hours,19 of which makes its residents good solar panel candidates.

Doing the Math

First, consider your average energy usage and the amount of solar power your home requires.

The average home in Missouri uses 1,039 kWh per month, which works out to approximately 34 kWh (or 34,000 watt-hours) per day.

If you divide watt-hours by peak sun hours, you get roughly 7,188 watts.

Now, say you’re using 300-watt solar panels. To generate enough watts for your home, you would divide 7,188 watts by 300, resulting in 23.96 (rounded up to 24) solar panels.

How To Find MO Solar Panels

You don’t have to know how to wire solar panels or the specific science behind the answer to the question “How does solar panel help the environment?” to benefit from panel systems. However, you do need to do your due diligence when choosing a Missouri solar panel provider.

The following guidelines can help you ensure you’re getting a fair deal:

Ask About Warranties

There are three types of warranties you should consider for your solar panel system:

- Manufacturer warranties: These protect solar panels from defects and offset potentially costly repairs.

- Production warranties: These guarantee panels will offset energy bills for several years after they’re installed (ensuring long-term energy savings).

- Workmanship warranties: These protect the system and your home from damage, leaks, etc., caused by installation (which is especially helpful in a rainy state like Missouri).21

Warranty programs can save you a lot of money in the long run, so don’t hesitate to ask about them (and request specific information on how the programs work, issues that could affect your eligibility, etc.).

Compare Quotes

Get quotes from multiple solar panel installation companies before you make a final decision. Ask for detailed quotes (most companies offer them for free — if they charge you, that’s a red flag) so you can compare each provider carefully.

When comparing, remember that cheaper isn’t always better, particularly when it comes to something like solar panels. If a price seems too good to be true, it’s probably because it is.

Ask About Experience and Qualifications

Carefully vet solar installers and consider their experience and qualifications.

Find out how long the company has been in business and what training processes its technicians go through. Make sure they can clearly and succinctly answer questions like “What are solar panels for?” and “What is the long-term impact solar has on your utility bills?” as well.

Don’t forget to read reviews from past customers, too. The company should have plenty of positive reviews backing up the quality of their work and the professionalism of their technicians.

Between the Missouri utility companies and the federal government, you can participate in a variety of programs and incentives for solar panel systems. From a 30% tax credit to rebates for switching to solar energy, residents of the ‘Show Me State’ can choose from several options that help them save money and minimize their carbon footprints simultaneously.

Reference the guidelines shared above to simplify the process of choosing a solar panel provider, applying for Missouri solar incentives, like tax credits, and calculating the number of panels you need, and you’ll be on your way to experiencing all the advantages that solar panels offer in Missouri.

Frequently Asked Questions About Missouri Solar Incentives

How Many Solar Panel Companies Does Missouri Have?

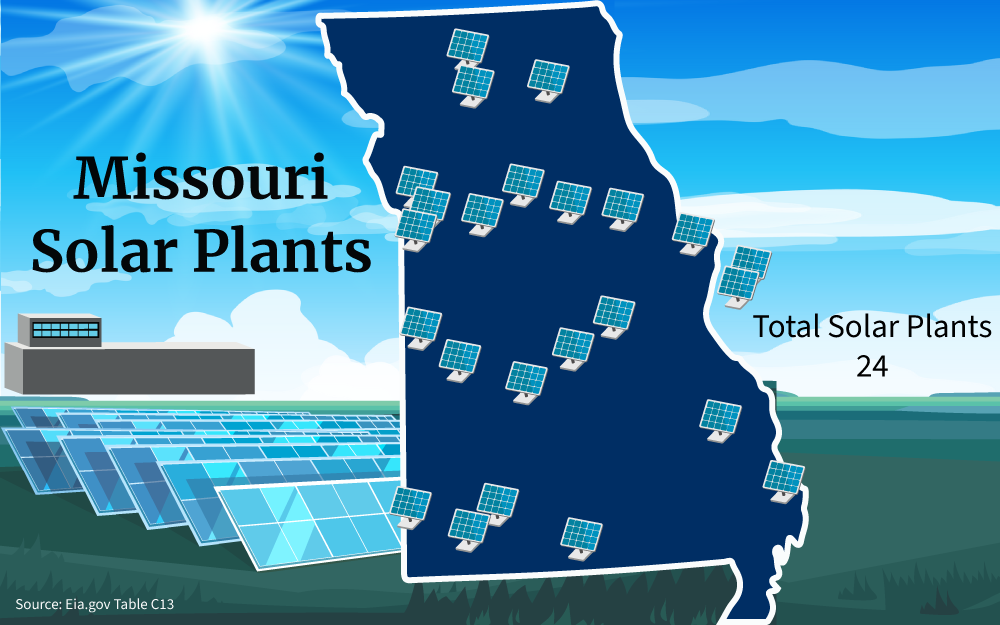

Missouri is home to 134 solar companies. That includes 21 manufacturers, 45 installers and developers, and 68 other solar businesses, so you have plenty of providers to choose from.

Will Amaren and Liberty Utility Rebates Be Extended Past December 31, 2023?

Neither of these companies has plans at this time to extend their rebate offerings past the December 31, 2023 deadline. Plans might change, though, so their customers should stay in touch.

Does Columbia Water and Light Offer Rebates for Peak Times?

Columbia Water & Light offers premium rebates during peak times (when there’s a greater system demand and electricity is the most expensive). They calculate premium rebates based on factors like roof tilt, shading, and azimuth angle (the angle between the sun and a line due north or south).22

References

1Solar Energy Industries Association. (2023). Missouri Solar. Solar Energy Industries Association. Retrieved September 8, 2023, from <https://www.seia.org/state-solar-policy/missouri-solar>

2Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 8, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

3City of Columbia. (2022). Solar Rebates. City of Columbia Missouri. Retrieved September 8, 2023, from <https://www.como.gov/utilities/columbia-power-partners/solar/solar-rebates/>

4City of Columbia. (2022). Solar Loans. City of Columbia Missouri. Retrieved September 8, 2023, from <https://www.como.gov/utilities/columbia-power-partners/solar/solar-loans/>

5Ameren Services. (2023). 2019-2023 SOLAR REBATES. Ameren Services. Retrieved September 8, 2023, from <https://www.ameren.com/-/media/missouri-site/files/environment/solar/2019-2023-solar-rebate-facts.pdf>

6Liberty. (2023). Solar Rebates Information. Liberty. Retrieved September 8, 2023, from <https://central.libertyutilities.com/all/commercial/ways-to-save/solar-rebates.html>

7Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved September 8, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

8Jude, T. (2023, April 7). Do Solar Panels Increase Home Value? Architectural Digest. Retrieved September 8, 2023, from <https://www.architecturaldigest.com/reviews/solar/do-solar-panels-increase-home-value>

9Missouri Legislature. (2023, August 23). Title X TAXATION AND REVENUE. Missouri Revisor of Statutes. Retrieved September 8, 2023, from <https://revisor.mo.gov/main/OneSection.aspx?section=137.100>

10State of Missouri. (2023). Property Assessed Clean Energy (PACE). Missouri Department of Natural Resources. Retrieved September 8, 2023, from <https://dnr.mo.gov/energy/what-were-doing/financial-assistance-opportunities/property-assessed-clean-energy-pace>

11Missouri Department of Natural Resources. (2023). Missouri Property Assessed Clean Energy (PACE) Interactive Map. Missouri Property Assessed Clean Energy (PACE) Interactive Map. Retrieved September 8, 2023, from <https://modnr.maps.arcgis.com/apps/webappviewer/index.html?id=8952955bc59b47fe9ef504537c70fa25>

12Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). Retrieved September 8, 2023, from <https://www.irs.gov/instructions/i5695>

13Solar Energy Technologies Office. (2023). Solar Integration: Inverters and Grid Services Basics. Energy Efficiency & Renewable Energy. Retrieved September 8, 2023, from <https://www.energy.gov/eere/solar/solar-integration-inverters-and-grid-services-basics>

14WGSI Solar. (2023). Solar Panel Cost, Missouri. WGSI Solar. Retrieved September 8, 2023, from <https://wgsi.org/solar-installation/solar-panel-cost-missouri/>

15National Renewable Energy Laboratory. (2023). Solar Leasing for Residential Photovoltaic Systems. National Renewable Energy Laboratory. Retrieved September 8, 2023, from <https://www.nrel.gov/docs/fy09osti/43572.pdf>

16U.S. Department of Energy. (2023). What is a Power Purchase Agreement? Better Buildings. Retrieved September 8, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

17Wakefield, F. (2023, September 1). How Many Solar Panels Do I Need? Market Watch Guides. Retrieved September 8, 2023, from <https://www.marketwatch.com/guides/home-improvement/how-many-solar-panels-do-i-need/>

18U.S. Energy Information Administration. (2023). 2021 Average Monthly Bill- Residential. U.S. Energy Information Administration. Retrieved September 8, 2023, from <https://www.eia.gov/electricity/sales_revenue_price/pdf/table5_a.pdf>

19The Green Watt. (2023). Average Peak Sun Hours By State (+ 50 State Winter, Summer Averages). The Green Watt. Retrieved September 8, 2023, from <https://thegreenwatt.com/average-peak-sun-hours-by-state/>

20State of Missouri. (2021, June 3). Net Metering and the Easy Connection Act – PUB2238. Missouri Department of Natural Resources. Retrieved September 8, 2023, from <https://dnr.mo.gov/document-search/net-metering-easy-connection-act-pub2238/pub2238>

21Dailey, D. (2023). Missouri sets two-year precipitation record with 106 inches, more possible. Missouri Climate Center. Retrieved September 8, 2023, from <http://climate.missouri.edu/news/arc/dec2009b.php>

22US Department of Commerce. (2023, September 8). Solar Position Calculator. National Oceanic and Atmospheric Administration. Retrieved September 8, 2023, from <https://gml.noaa.gov/grad/solcalc/azel.html>

23Screenshot from Internal Revenue Service. IRS. Retrieved from <https://www.irs.gov/pub/irs-pdf/f1040x.pdf>